In mid-September 2025, the CPCA and CAAM successively released data on the automotive industry and passenger vehicle market for August 2025. CAAM stated that from January to August this year, China's auto production and sales both exceeded 20 million units for the first time. Among them, NEVs and auto exports continued to show good momentum, while the traditional fuel vehicle market stabilized....... SMM compiled relevant data on the auto market and power battery market in August for readers to review.

Automotive Sector

CAAM: China's Auto Production and Sales Both Exceeded 20 Million Units from January to August, Up 12.7% and 12.6% YoY, Respectively

According to CAAM data, in August, auto production and sales reached 2.815 million and 2.857 million units, up 8.7% and 10.1% MoM, respectively,and up 13% and 16.4% YoY, respectively. From January to August, auto production and sales reached 21.051 million and 21.128 million units,up 12.7% and 12.6% YoY, respectively, with production growth flat from January to July and sales growth expanding by 0.6 percentage points. This also marks thefirst time China's auto production and sales both exceeded 20 million units.

CAAM: NEV Production and Sales Both Exceeded 9.6 Million Units from January to August, Up Over 35% YoY

In August, NEV production and sales reached 1.391 million and 1.395 million units,up 27.4% and 26.8% YoY, respectively, with NEV sales accounting for 48.8% of total new auto sales.

From January to August, NEV production and sales reached 9.625 million and 9.62 million units,up 37.3% and 36.7% YoY, respectively, with NEV sales accounting for 45.5% of total new auto sales.

CAAM: NEV Exports Doubled in August, Up 87.3% YoY from January to August

In August, auto exports reached 611,000 units, up 6.2% MoM,and up 19.6% YoY. From January to August, auto exports reached 4.292 million units,up 13.7% YoY.

In August, NEV exports reached 224,000 units, down 0.6% MoM,and doubled YoY. Among them, passenger NEV exports reached 220,000 units, down 0.2% MoM and up 1.1 times YoY; commercial NEV exports reached 4,000 units, down 15.8% MoM and up 9.5% YoY.

From January to August, NEV exports reached 1.532 million units,up 87.3% YoY. Among them, passenger NEV exports reached 1.473 million units, up 85.1% YoY; new energy commercial vehicle exports reached 58,000 units, up 1.7 times YoY.

The Passenger Car Association also released the passenger car market situation for August 2025. According to data from the Passenger Car Association, retail sales in the national passenger car market in August reached 1.995 million units,up 4.6% YoY, up 8.2% MoM; cumulative retail sales from the beginning of the year reached 14.741 million units,up 9.5% YoY. It is reported that this data not only set a new historical high for retail sales in August but also increased by 3.7% compared to the previous historical high of 1.92 million units in August 2023.

In terms of NEVs, retail sales in the national passenger car market in August reached 1.995 million units,up 4.6% YoY, up 8.2% MoM; cumulative retail sales from the beginning of the year reached 14.741 million units,up 9.5% YoY.

Regarding exports, the Passenger Car Association stated that with the scale advantages and market expansion demands of China's NEVs, Chinese-made new energy brand products are increasingly going global, with continuously growing recognition overseas. Among them, plug-in hybrids accounted for 31.7% of NEV exports (19.5% in the same period last year). Although recently affected by some external disruptions, the export growth momentum of domestic plug-in hybrids to developing countries is rapid, with bright prospects. In August, passenger NEV exports reached 204,000 units,up 102.7% YoY,down 6.5% MoM. They accounted for 40.9% of passenger car exports, an increase of 16.6 percentage points compared to the same period last year; among them, pure electric vehicles accounted for 66% of NEV exports (80.4% in the same period last year), with A00+A0 class pure electric vehicles, as the core focus, accounting for 38% of pure electric exports (23% in the same period last year).

Regarding the passenger car market in August, the Passenger Car Association commented that the cumulative retail growth rate of the domestic car market this year continued to rise from 1.2% in January-February to 11% in January-June, with July-August showing a deceleration characteristic due to a high base, consistent with the "low start, high middle, flat end" trend predicted at the beginning of the year. Retail sales in August this year set a new historical high, increasing by 3.7% compared to the previous historical high of 1.92 million units in August 2023, showing a gradually moderating growth trend.

Cui Dongshu, Secretary General of the Passenger Car Association, analyzed, "In August, passenger car producer retail sales, exports, wholesale, and production all reached historical highs for the month, demonstrating a strong market recovery momentum." In particular, NEV exports broke the historical records for all previous months, becoming an important driving force for market growth.

CPCA believes the August 2025 passenger-vehicle market displayed the following characteristics: 1. Retail sales, exports, wholesale and production all set new August records; new-energy exports reached an all-time monthly high. 2. January-July domestic retail sales posted a 10% YoY cumulative gain; the January-August figure eased to 9.5%, with July and August each trimming the cumulative pace by one percentage point, foreshadowing a “low-early, mid-year peak, flat-late” profile. 3. Headline price cuts were milder, yet hidden incentives—annual-model feature upgrades, owner-benefit tweaks, the program of large-scale equipment upgrades and consumer goods trade-ins plus larger factory subsidies—proliferated; August new-energy sales promotions rose 10.7% MoM. 4. August wholesale BEVs surged 38.5% YoY, PHEVs 5.0% YoY, while EREVs fell 9.5% YoY; among new entrants, the BEV-to-EREV mix shifted from 56%:10.2% last year to 64%:7.7%. 5. As anti-involution deepened, overall industry inventory fell 90,000 units in August (160,000 a year earlier) and new-energy inventory dropped 50,000 units. 6. New-energy penetration in domestic retail reached 55.2% in August, supported by retirement-and-renewal, replacement demand and the continued purchase-tax exemption. 7. January-August independent-brand ICE exports totaled 1.8 million units, down 10% YoY; independent-brand new-energy exports hit 1.14 million units, up 123% YoY, accounting for 38.8% of independent exports.

Power Battery Segment

January-August 2025 China’s combined power and other battery sales reached 920.7 GWh, up 58.2% YoY.

August sales were 134.5 GWh, up 5.7% MoM and 45.6% YoY. Of this, power battery sales were 98.9 GWh (73.5% of the total), up 8.5% MoM and 44.4% YoY; other battery sales were 35.6 GWh (26.5%), down 1.4% MoM and up 49.0% YoY.

January-August cumulative sales were 920.7 GWh, up 58.2% YoY. Power battery cumulative sales were 675.5 GWh (73.4%), up 49.7% YoY; other battery cumulative sales were 245.2 GWh (26.6%), up 87.6% YoY.

January-August 2025 China’s power battery installations totaled 417.9 GWh, up 43.1% YoY.

August installations were 62.5 GWh, up 11.9% MoM and 32.4% YoY. Among them, ternary battery installations reached 10.9 GWh, accounting for 17.5% of total installations, down 0.1% MoM and down 10.0% YoY; LFP battery installations reached 51.6 GWh, accounting for 82.5% of total installations, up 14.8% MoM and up 47.3% YoY.

From January to August, China's cumulative power battery installations reached 417.9 GWh, up 43.1% YoY. Among them, cumulative ternary battery installations were 77.4 GWh, accounting for 18.5% of total installations, down 9.7% YoY; cumulative LFP battery installations were 340.5 GWh, accounting for 81.5% of total installations, up 65.1% YoY.

BYD Tops Sales Again, Multiple NEV Makers Hit Record High Deliveries in August

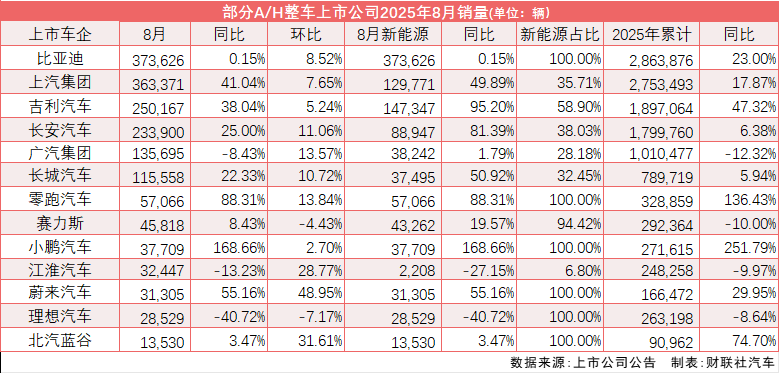

The chart below shows the August performance of 13 A/H-share listed automakers compiled by a Cailian Press journalist, with 10 automakers achieving YoY growth, accounting for 77%. Among them, BYD, Geely, SAIC, and Changan Auto continued to drive growth in the new energy sector, serving as the main drivers of market expansion.

As China's "EV leader," BYD ranked first in automaker sales with 373,626 units, up 0.15% YoY. From January to August, BYD's cumulative sales reached 2,863,876 units, up 23% YoY.

Among new automakers, Leap Motor delivered 57,066 units in August, up over 88% YoY, hitting a new record high, and has maintained the top monthly sales among new automaker brands for six consecutive months; cumulative deliveries from January to August 2025 reached 328,859 units, surging 136.43% YoY.

XPeng Motors delivered 37,709 new vehicles in August, surging 168.66% YoY, with monthly deliveries hitting a new record high; cumulative deliveries from January to August 2025 reached 271,615 units, soaring 251.79% YoY. Notably, the new XPeng P7 officially launched on August 27, with over 10,000 firm orders within 7 minutes, setting XPeng's fastest record for breaking 10,000 orders for a new model.

For NIO, it delivered 31,305 units in August, up 55.16% YoY, reaching a record high. Cumulative deliveries from January to August 2025 reached 1,166,472 units, up 29.95% YoY. Among them, the Ledo L90 delivered 10,575 units in its first month, becoming the fastest model in NIO's history to break 10,000 sales.

Li Auto delivered 28,529 new vehicles in August, down 40.72% YoY; cumulative deliveries from January to August totaled 263,198 units, down 8.64% YoY. It is worth mentioning that Li Auto stated that since the launch of the Li MEGA Home, its sales have continued to grow, and it has been the sales champion in the Chinese market for luxury MPVs priced above 500,000 yuan for three consecutive months. The strong sales of the Li MEGA have driven up the brand's market share. In June, our market share in the pure electric vehicle segment above 500,000 yuan exceeded 30%, and in July, it surpassed 35%, ranking first in the industry.

The China Passenger Car Association (CPCA) indicated that the wave of anti-involution is driving the auto market toward a transformation characterized by "reduced price cuts and moderated sales promotions," making market operations increasingly stable. According to statistics based on automakers' official price reductions or substantial breakthroughs in new car prices hitting the lowest guidance prices in nearly two years: in August this year, 23 car models saw price reductions (compared to 29 in the same period last year and 25 in the same period of 2023), indicating that the current market remains relatively stable. In August 2025, the sales promotion intensity for new energy vehicles remained at a moderately high level of 10.7%, up 2.5 percentage points YoY and slightly increasing 0.5 percentage points MoM. In August 2025, the sales promotion intensity for traditional internal combustion engine vehicles stabilized at 22.9%, down 0.5 percentage points MoM but up 0.9 percentage points YoY.

Faced with a complex situation of increasing external shocks and overlapping internal difficulties and challenges, strong counterbalancing measures supported the economy and the auto market in H1. As the policy differences in trade-in subsidies across provinces became apparent, regional sales growth rates diverged, with some regions even experiencing YoY sales declines of over 10% in July. However, the divergence in regional growth rates improved again in August.

Regarding the auto market in August, the China Association of Automobile Manufacturers (CAAM) commented that in August, China's macroeconomic climate generally maintained an expansionary trend, with auto production and sales achieving YoY growth of over 10%. Among these, new energy vehicles and auto exports continued to show positive trends, while the traditional fuel vehicle market stabilized. The "program of large-scale equipment upgrades and consumer goods trade-ins" policy continued to gain traction, with timely introductions of policies such as fiscal interest subsidies for personal consumption loans. Automakers showed high enthusiasm for launching new models, and industry-wide efforts to combat "involution" continued to yield results, contributing to overall stable auto market operations.

On August 22, the State Council executive meeting fully affirmed the significant achievements of the large-scale equipment upgrades and consumer goods trade-in policy in stabilizing investment, expanding consumption, promoting transformation, and benefiting people's livelihoods. It also called for, based on a thorough summary and evaluation of the policy implementation, strengthened coordination, improved implementation mechanisms, and better leveraging of the policy's role in expanding domestic demand. Additionally, it emphasized ensuring that subsidy funds are used effectively and yield tangible results, further enhancing support through fiscal, tax, and financial policies, innovating consumption and investment scenarios, optimizing consumption and investment environments, and adopting comprehensive measures to unleash domestic demand potential. The clarity of these policies has bolstered enterprise confidence and will play a crucial role in driving auto market growth in H2.

Looking ahead to September 2025, there will be 22 working days, the same as the same period last year, providing relatively ample time for production and sales. Since the 2024 Mid-Autumn Festival fell in September, while the 2025 festival will occur during the National Day holiday, market activity in September this year is expected to be higher.

In recent years, the high sales characteristic of the "September peak season" in the auto market has become increasingly evident. From 2015 to 2019, September retail sales accounted for an average of 8.8% of the annual total. After the three years of the pandemic, this proportion reached 9.3% in 2023-2024. In H2 2024, monthly sales increased significantly due to policy support, resulting in a relatively high base for September this year. Additionally, subsidy funds in some regions will be disbursed in a controlled manner, making it clear that the growth rate in September will slow down.

With the continuous advancement of anti-involution efforts, leading automakers are striving to maintain relatively stable market prices and ensure gradual improvement in the industry chain's funding, though their profit pressure remains high. In July, the automotive industry's profit margin was only 3.5%, but it is expected to improve later.

It is worth mentioning that on July 28, a symposium for responsible comrades of national industry and information technology authorities was held in Beijing. The meeting emphasized the need to consolidate the results of the comprehensive rectification of "involution-style" competition in the NEV industry, strengthen the governance of key industries such as PV, and use standard upgrades to force outdated capacity to exit.

On September 10, six departments, including the Ministry of Industry and Information Technology, jointly issued the "Notice on Carrying out a Special Campaign to Rectify Online Chaos in the Automotive Industry," deciding to launch a three-month nationwide special campaign to rectify online chaos in the automotive industry. This initiative will urge enterprises to standardize marketing and promotional practices, create a favorable public opinion environment, and escort the high-quality development of the automotive industry.